tags: how to submit in adsense tax info, adsense tax info, submit in adsense tax info, tax info, submit tax info,google adsense tax information india

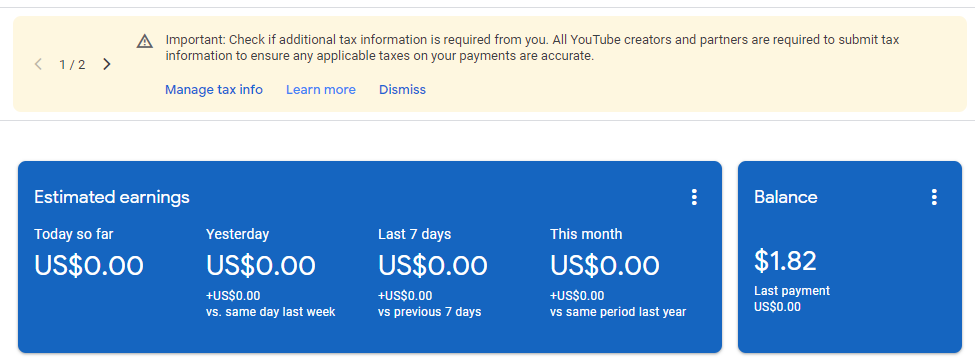

Sign in to your AdSense account, we will get the below notification

|

| how to submit in adsense tax info, adsense tax info |

Either we can click on "manage tax info" if its showing popup notification in dashboard or we can check in notification.

If notification is not available you can to the payments option,

Click Payments and Click Manage settings

Scroll to "Payments profile" and click on pencil icon to edit "United States tax info".

Click Manage tax information.

On this page you'll find a guide that will help you to select the appropriate form for your tax situation.

1 - Account type

Individual - self account

Non-individual / entitiy - official/firms/organization

Here we have Individual account so we will select it and click on Next button.

In the new option we are not a citizen or resident of US, so we will select no and click on Next button.

In the next option we will select W-8 tax type, if are submitting tax info for individual then we will select W-8BEN othrewise non-individual we will click on W-8ECI.

Here we have individual so we select W-8BEN and click on "START W-8BEN FORM" button.

Now we will fill W-8BEN form below

Name of Individual - it will auto filled

DBA - optional, we can leave it blank

Country/Region of citizenship - select country from the list

Foreign TIN - We will provide our PAN Number

US ITIN or SSN - its optional so we can leave it blank

In the next window we will fill up permanent or mailing address, address should be same as payment profile which you got the PIN number.

3 - Tax treaty

in this option we are claiming a reduced rate of withholding under a tax treaty so we will select yes and then select country.

once we select country, 3 more option will be available like;

2 - Motion Picture and TV Royalties (such as certain YouTube Movies and Shows and Play partners)

3 - Other Copyright Royalties (such as Play and YouTube Partner Program)

Now we have to select the above special rates and conditions

First we will check on Services ( Such as Adsence ), means we are using this service

Select Article and paragraph - Article 7 and paragraph 1

Withholding rats - 0%

Now we will check on second option "Motion Picture and TV Royalties" if we are using YouTube channel.

For the third option for Other Copyright Royalties

In both option we will select below and click on next

Select Article and paragraph - Article 12 and paragraph 2A II

Withholding rats -15%

4 - Document Preview

Verify document and check on confirm

5 - Certification

We will provide name of individual account holder and check on "Yes. I am the person listed in the signature section and am completing this from on my own behalf"

Full legal name - Rakhi Carpenter

6 - Activities and services performed in US and Affidavit

Activities and services performed

In the first radio we will select no because we are performing the activity US and others, if you are performing activity only in US then you can select Yes.

Status change affidavit

second radio option we have 2 choice, if we did not received any payment in absence then we will select on first "I am providing the tax info for new or existing payment profile that hasn't received payment"

otherwise select second one and submit

After submitting final screenshot and it will auto approve

Thanks you !!

I hope this topic gave you all the information you needed. If you have any further questions or would like more detailed directions feel free to contact us using any of the following sources.We look forward to talking to you.